But with fierce competition for prime locations, securing the right franchise—and the right funding—requires strategy.

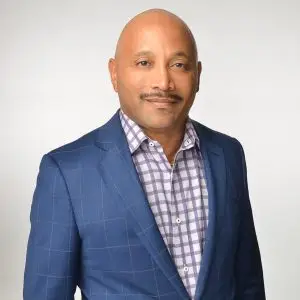

As a veteran financial advisor to Canadian franchise owners, I’ve guided countless clients through successful acquisitions. Here’s how to leverage programs like the Canada Small Business Financing Loan (CSBFL) and tax incentives to make your 2025 franchise purchase a triumph.

Start with market research (Beyond the hype)

Not all franchises are created equal. Target industries with resilient demand, such as healthcare, quick-service restaurants (QSRs), or home services. Use tools like Statistics Canada’s Consumer Trends Reports to identify underserved markets.

“Look for brands with strong unit economics and a track record of supporting multi-location owners.”

- Tax bonus: Deduct market research costs (e.g., feasibility studies, travel) as start-up expenses.

Master the CSBFL: Your gateway to affordable financing

The Canada Small Business Financing Loan (CSBFL) is a government-backed program that reduces lender risk, making it easier for franchisees to secure funding. Here’s how to use it:

- What’s covered: Up to $1 million for purchasing assets like equipment, leasehold improvements, or even franchise fees.

- Terms: Loans up to 10 years, with flexible repayment schedules.

- Eligibility: Most franchises registered with the Canadian Franchise Association (CFA) qualify.

- Pro Tip: Pair the CSBFL with provincial grants to minimize out-of-pocket costs.

Negotiate like a pro (Before you sign)

Franchise agreements often hide costs like mandatory tech upgrades or marketing fund contributions. Key negotiation points:

- Royalty relief: Ask for reduced royalties for the first 6–12 months to ease cash flow.

- Territory exclusivity: Secure a protected radius to avoid cannibalization from other franchisees.

- Renewal terms: Lock in renewal fees upfront to avoid surprises.

Tax tip: Legal and professional fees tied to acquisition are deductible as start-up costs.

Turn tax credits into acquisition fuel

Canada’s tax code rewards strategic buyers:

- Accelerated capital cost allowance (CCA): Write off equipment, signage, or technology purchases faster (up to 100% in Year 1 for certain green assets).

- Lifetime capital gains exemption (LCGE): If you eventually sell the franchise, shield up to $1 million in capital gains from taxes (conditions apply).

- SR&ED credits: Innovating during setup (e.g., customizing POS systems)? Claim R&D tax credits.

Conduct ironclad due diligence

Avoid “rosy scenario” pitfalls by scrutinizing:

- Financials: Review the franchise’s unit-level profit margins and same-store sales growth.

- Legal compliance: Ensure the franchisor has a clean record with provincial regulators.

- Existing owner feedback: Talk to current franchisees about support, profitability, and pain points.

“If the franchisor restricts access to current owners, walk away.”

Plan for post-acquisition success

Your work starts after the deal closes. Prioritize:

- Staff retention: Use the Canada Job Grant to fund training for inherited employees.

- Local marketing: Allocate 5–7% of revenue to hyper-local campaigns (e.g., community sponsorships, geo-targeted ads).

- Tech upgrades: Modernize systems with tools eligible for the CSBFL or green tax rebates.

Conclusion

2025 is a golden year for franchise acquisitions—if you combine due diligence with smart financing.

By leveraging the CSBFL, negotiating favorable terms, and maximizing tax incentives, you’ll position yourself for immediate profitability and long-term wealth.

Remember: The best franchises aren’t just bought; they’re built.