The answer might surprise you. The U.S. franchise landscape operates under a complex web of federal and state regulations that can trip up even the most successful Canadian franchisors. While your brand may be thriving across Canada’s provinces, the U.S. presents unique legal challenges that require careful planning long before you sign your first American franchisee.

Through our experience with international franchise expansions, we’ve observed that successful franchisors build their legal foundation on three critical pillars before they cross the border.

Trademark protection strategy

Your Canadian trademark registration provides zero protection in the United States. None. This reality catches many franchisors off-guard, especially when they discover someone else is already using their brand name south of the border.

The trademark landscape between our countries operates independently. You’ll need to file separate U.S. trademark applications through the United States Patent and Trademark Office. This process takes months, not weeks, and should begin well before you’re ready to sign franchisees.

Essential steps for trademark protection:

- Conduct comprehensive searches of existing U.S. trademarks, domain names, and business registrations

- Identify potential conflicts that may require strategic decisions about rebranding or coexistence agreements

- File applications in multiple trademark classes if your franchise spans different business categories

- Consider allowing sufficient time for the approval process before launching franchise sales

Corporate structure planning

Canadian franchisors can offer franchises in the U.S. without a U.S. entity, but most establish a U.S. subsidiary for liability, accounting, banking, and state-law practicalities. This decision impacts everything from taxation to liability protection to franchise registration requirements.

Most international franchisors establish a U.S. subsidiary to serve as the franchisor entity. This structure provides several key advantages:

- Limits liability exposure to your Canadian parent company

- Simplifies compliance with U.S. franchise laws

- Creates cleaner financial reporting for both countries’ regulatory requirements

- Facilitates banking relationships and insurance coverage

The choice of state for incorporation matters significantly. Your decision should align with your franchise registration strategy and long-term business plans.

Additional requirements include establishing U.S. banking relationships, accounting systems that comply with both Canadian and U.S. requirements, and appropriate insurance coverage for your American operations.

FDD and registration strategy

The U.S. Franchise Disclosure Document required in the United States contains 23 specific disclosure categories that must be prepared according to Federal Trade Commission guidelines. Additionally, franchisors must provide the FDD to prospective franchisees at least 14 days before any agreement is signed or payment is made, and must provide ready-to-sign agreements at least 7 calendar days before signing.

But meeting federal standards is only the first step — fourteen U.S. states have their own additional registration requirements at the state level.

Key registration requirements include:

- State-by-state review and approval processes that can take weeks to months

- Financial assurances required for franchisors in certain states

- Annual renewals with updated documentation

- When a material change occurs, file a post-effective amendment promptly (e.g., Minnesota and Wisconsin within 30 days; Illinois: file an amendment within 30 days after the close of the fiscal quarter in which a material change occurred; Washington as soon as reasonably possible)

The registration process varies by state and timelines vary by state and by comment cycles. You cannot legally offer franchises in registration states until you receive approval.

Annual compliance creates an ongoing administrative burden. Your FDD must be updated within 120 days of your fiscal year-end, and state registration/filing triggers annual renewals and prompt post-effective amendments for material changes.

The ROI of getting it right

The legal foundation for U.S. expansion represents a significant investment. FDD preparation, trademark applications, state registrations, and ongoing compliance require planning and budget for comprehensive market entry.

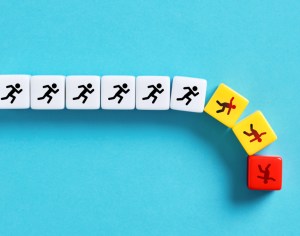

But consider the alternative. We’ve seen Canadian franchisors attempt shortcuts only to face trademark disputes, regulatory enforcement actions, or expensive restructuring projects that could have been avoided with proper planning.

Your legal foundation isn’t just about compliance — it’s about creating scalable systems that support profitable growth. The franchisors who invest in solid legal infrastructure from day one build sustainable competitive advantages that compound over time.

The U.S. market offers tremendous opportunities for Canadian franchisors willing to respect its complexity. Working with experienced counsel like Spadea Lignana Franchise Attorneys to build the right legal foundation will position your brand for lasting success in the world’s largest franchise market.