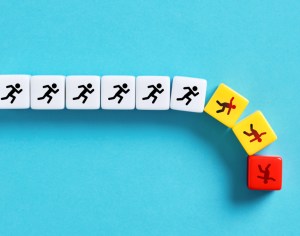

When a franchise system grows too fast without the right support, the cracks don’t show in head office, they show at the unit level.

Operators burning out. Locations missing royalty payments. Underfunded buildouts. Overdue HST. Silent financial stress bubbling just under the surface until a location fails.

Most of the time, the product isn’t the problem. The brand isn’t the problem. The franchisee, frankly, isn’t even the problem. It’s the financial foundation or lack of one.

At PFG Financial and PMG Accounting, we work with franchisors and franchisees across Canada and the US, and the same story plays out over and over again: great operators with strong work ethic and passion, who were never set up for financial success.

Not because they didn’t care. But because nobody showed them how.

A system is only scalable if its operators are stable

When a franchisee signs their agreement, it feels like the beginning. But for many, the real pressure starts after the paperwork is done. Rent hits before revenue. Payroll hits before profit. Royalty payments, equipment issues, tax deadlines it piles up fast.

Without structure, the default is survival.

We’ve seen franchisees who were brilliant with customers but panicked around spreadsheets. We’ve seen successful stores nearly implode over payroll errors, misfiled HST, or debt repayments they didn’t fully understand when they signed. And often, by the time a franchisor finds out, the damage is already done.

You can’t fix what isn’t being tracked

The strongest franchise systems are starting to recognize this. They’re shifting from reactive to proactive, not just providing branding and training, but helping operators build actual businesses, not just branded jobs.

That means:

• Assessing financial readiness before the business plan gets written

• Structuring incorporations and registrations correctly from day one

• Giving operators real visibility into cash flow, debt service, and breakeven points

• Providing clear, consistent bookkeeping and payroll — month after month

• Offering advisory support that goes beyond tax season

Not because it’s flashy. Because it works.

What we’ve learned from being in the trenches

We’ve worked with hundreds of franchisees. We’ve sat in discovery calls where a great candidate was two tweaks away from funding approval. We’ve helped operators who nearly walked away from a concept they loved, just because they felt overwhelmed.

The systems that succeed are the ones where financial infrastructure isn’t an afterthought. It’s built in from step one.

At PFG Financial and PMG Accounting, we’ve developed a six-step approach that gives new franchisees the structure they need to succeed and gives franchisors the confidence that each new location is built on solid ground.

• Step 1: We assess financing eligibility before anything else. No time wasted chasing funding that won’t land.

• Step 2: We structure the corporation properly — the right legal setup, HST registration, and banking structure so the franchisee can actually get paid (and avoid CRA issues down the line).

• Step 3: We create a CPA-vetted, lender-ready business plan based on actual numbers, not inflated projections.

• Step 4: We structure funding through CSBFL, business lines of credit, and leasing, covering up to 90% of startup costs in many cases.

• Step 5: We handle monthly accounting and payroll — clean books, clean filings, and no surprises.

• Step 6: We provide CFO-level advisory as needed, especially when it’s time to scale or deal with audits.

Each step builds on the last. Skip one, and you feel it later in the form of tax notices, bank rejections, or franchisee stress. But when followed in order, it creates a clear path from onboarding to profitability.

The bottom line? brand health starts at the unit level

You can’t scale what isn’t stable.

The best marketing in the world can’t save a franchisee who doesn’t understand their numbers.

And the best product can’t carry a system full of operators quietly drowning in overdue filings and unpredictable cash flow.

But with the right foundation, that story changes.

We’ve seen what happens when operators get set up the right way. They perform better. They ask better questions. They build second units sooner. And franchisors sleep better knowing each new location isn’t just launched it’s ready.

That’s the future of franchising. Not just growth for growth’s sake, but growth that lasts.

And it starts with the numbers.

This article comes courtesy of PFG Financial and PMG Accounting, who support franchisors and franchisees across North America in building strong financial foundations for long-term success.